Wearing a freshly pressed uniform. Waking up at 0430 for PT. Knowing how to properly salute. These are all great habits to develop in the military.

Another great habit is saving money. Not only saving money, but knowing what you do with your savings is just as important. Stashing away those extra dollars in a checking or savings account is a good first step, but you may be more likely to tap in to those accounts knowing the funds are accessible. A good long and short-term solution might be share certificates.

What are certificates and how do they work?

There are two key differences between a certificate and your typical checking and savings accounts. A certificate generally has a higher interest rate than those accounts, meaning you’ll earn more from your money over time. Second, the certificate requires you agree to a set period of time where your money must remain in the account – this is known as the term length. When a term length comes to an end, a certificate reaches maturity. This means you now have access to the funds.

Whatever your goals may be – a new car, down payment on a house - there is a certificate out there to help achieve them. Choosing a longer term length will mean that your money will be untouchable for a longer period of time and can generate a higher return. For example, think of using this option if you know you eventually would like to purchase a home in the next 10 years. A shorter term length, say between three to five years, is a good option for meeting goals, such as a down payment on a car or for a nice family vacation.

Standard and special certificates

Depending on your financial situation, you may need to decide between a standard certificate and a special certificate. Let’s say you recently received an enlistment or reenlistment bonus, or have your wealth stored in a savings account. Consider using a standard certificate. With a standard certificate, you can deposit that sum of money and watch it grow.

If you are not able deposit a large amount of money, you can open a special certificate. This type of certificate allows you to open an account with a small amount of money. As funds become available in your paycheck, you can schedule deposits into your certificate. The more you deposit, the more you’ll earn through interest. Keep in mind both standard and special certificates often have limitations when it comes to the total amount of money allowed in the account.

Certificate laddering

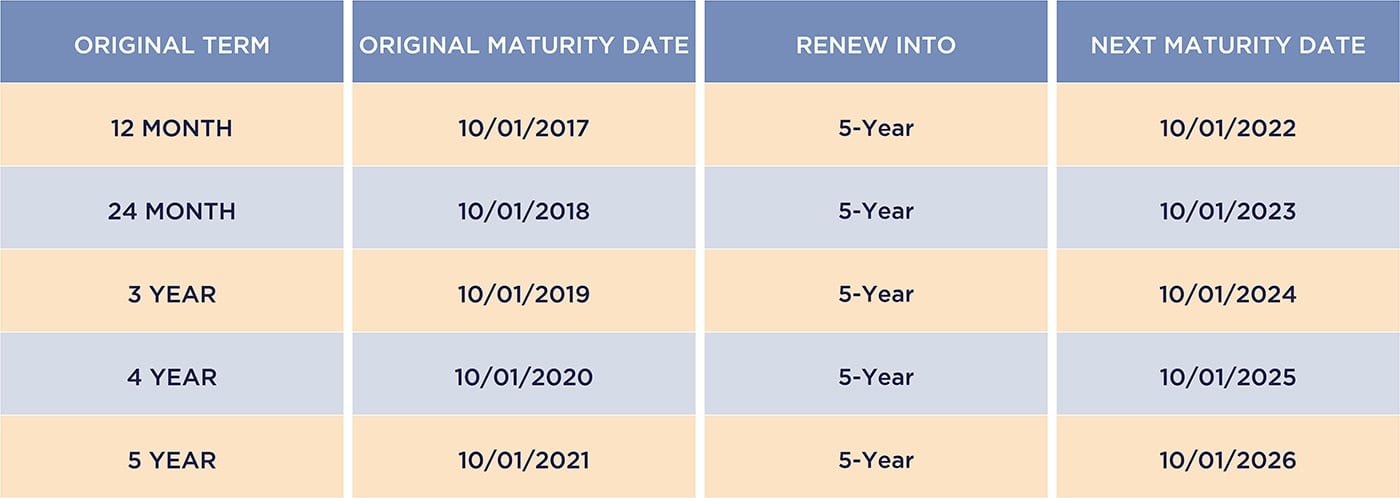

Just like when planning an operation, having an effective strategy produces results and brings peace of mind. Certificate laddering, a well-known strategy that uses multiple certificates, can provide you with a steady and stable source of savings over time.

For example, instead of putting $5,000 toward one certificate, you can put $1,000 in five certificates with staggering term lengths (one year, two year, three year terms, etc.). Once the youngest certificate matures, you then roll that lump sum into the highest "rung" of the ladder. This allows you to maximize your earnings while having periodic access to your money as needed. You can always calculate how much you’d save with a certificate calculator.

Put your savings to work!

Now that you know how to develop the habit of saving with certificates, it’s time to take the next step. Try reaching out to a trusted financial institution to help you identify your goals and match a certificate to help meet them. As we all know, the earlier you start great habits, the sooner you will see results!

You May Also Like:

* Certificate Calculator* Savings Strategies*

©2016 Navy Federal Credit Union. All images used for representational purposes only; do not imply government endorsement. Navy Federal is federally insured by NCUA and an Equal Housing Lender.