Just one day after the launch of an online training program about the new Blended Retirement System, more than 1,000 service members had already logged in to start their courses, according to a defense official.

The training is available on Joint Knowledge Online for those with a common access card. But family members and others without a CAC can also take the course at Military OneSource.

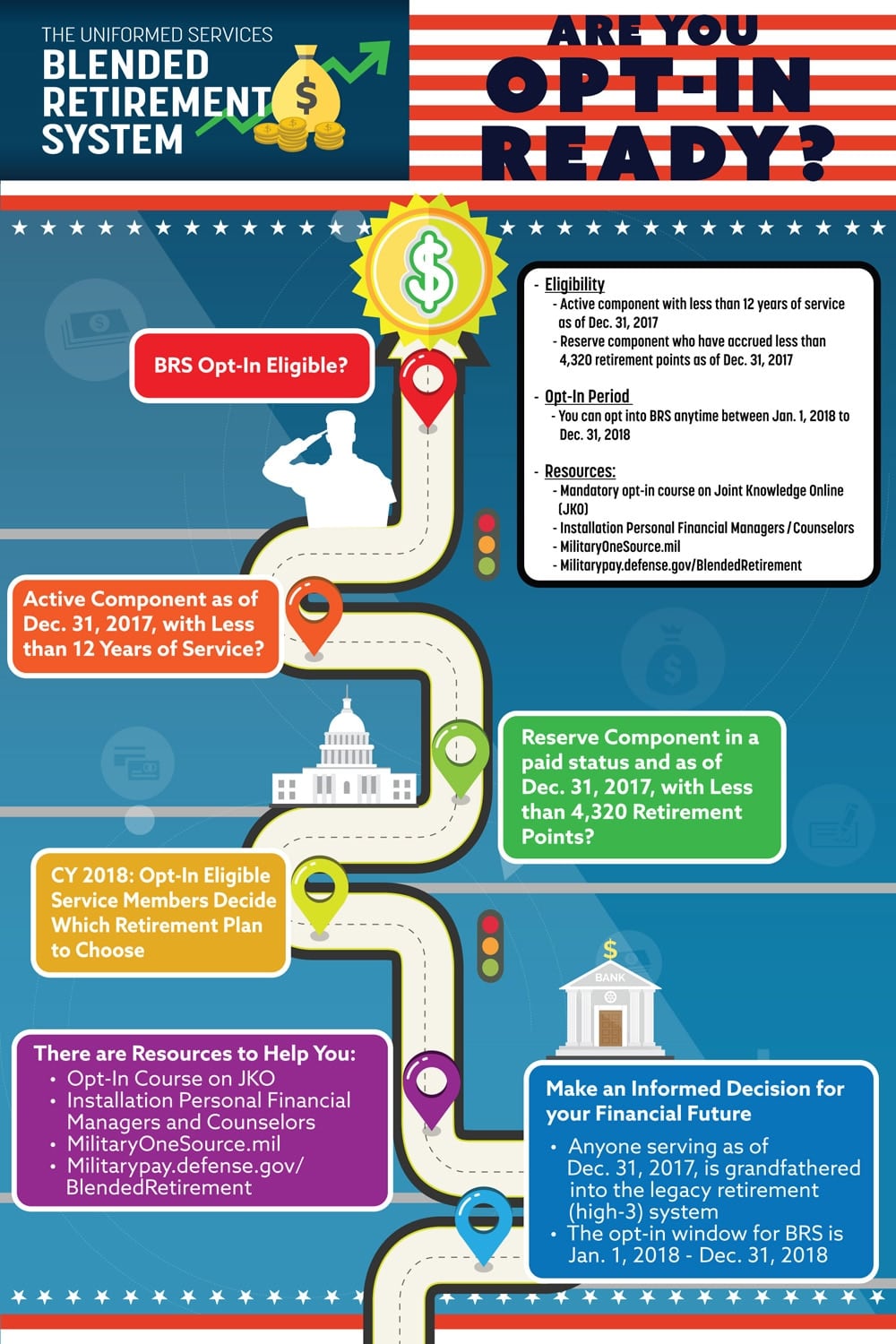

No one can make the decision about the retirement system yet – eligible service members will be able to opt in to the new system between Jan. 1 and Dec. 31, 2018. But everyone who is eligible to make a choice is required to take the course at some point before the end of 2018, even if they intend to stay with the current retirement system, according to a defense official.

The full course takes between one and a half to two hours to complete, although the course-taker can pause the process and restart it later. There are nine lessons and a certificate upon completion. Officials are also considering an option that would allow service members to test out of certain parts of the training.

This reform of the military retirement system became law in 2015 and takes effect Jan. 1, 2018. The new retirement benefit offers a smaller pension check, 40 percent of basic pay after 20 years, yet also includes monthly government contributions to an individual's retirement account.

"It's one of the most significant changes to military pay and benefits that we've had over the past 70 years," said Anthony Kurta, acting undersecretary of defense for personnel and readiness, during a press briefing Wednesday. "We'll now be able to offer 85 percent of our force a portable government retirement savings while maintaining a traditional pension for those that serve at least 20 years."

DoD has been working for more than 18 months to develop policy regarding the implementation of the new retirement system, such as how different aspects of the benefit will be calculated, and outlining responsibilities for service officials. That policy was signed Jan. 27 by Deputy Defense Secretary Robert Work.

Those eligible to make a decision to opt in to the new blended retirement system are:

- Active duty members with less than 12 years of service as of Dec. 31, 2017.

- Reserve component members who have accrued less than 4,320 retirement points as of Dec. 31, 2017.

Active duty service members with more than 12 years of service as of Dec. 31, 2017, automatically remain in DoD's legacy retirement system.

Anyone else on active duty as of Dec. 31, 2017, will have a choice in 2018 as to whether they will stay with the previous retirement system or move to the new system. No one is automatically enrolled in the new system – except for anyone entering the military on or after Jan. 1, 2018.

"There’s no single right answer for any service member as to which retirement system, and [DoD] doesn’t take a position on that decision," said Jeri Busch, DoD director of military compensation policy. "That’s best made by our service members and their families."

A Defense Department-created "road map" to the Blended Retirement System.

Photo Credit: Defense Department DoD's Blended Retirement System road mapAmong the broad topics for lessons in the service member training:

- The importance of lifelong financial security.

- Financial planning concepts and the Thrift Savings Plan.

- Differences in the "High-3" system and the Blended Retirement System.

- Important factors to consider.

Two other courses have already been rolled out to prepare senior leaders and financial counselors to help provide resources to service members. Since last summer, about 120,000 senior leaders have completed a basic course about the new plan and their responsibilities for pointing troops to the right tools. More than 9,000 professionals have completed a training course on the options available and how to help troops get the information they need. Those include personal financial management counselors on bases, counselors who provide financial counseling to troops and families through Military OneSource, retirement services personnel, and others.

In the next four to six weeks, officials expect to release a Blended Retirement System calculator, which will allow service members to plug in various scenarios to help them compare their benefits in the old system versus the new system, using their personal career and life goal information.

Kurta said officials had to wait until all the policies were signed in order to include the relevant elements for the calculations.

DoD officials have called on subject matter experts to develop the training and tools, and they also have brought in service members to get their feedback on the information they need to make decisions, said Wayne Boswell, DoD director of financial readiness.

"The launch doesn't stop yesterday," Boswell said, adding that officials will continue to receive and listen to feedback from service members and their families to make any improvements in the training and tools.

The CAC-enabled course, limited to service members, is found at https://jkosupport.jten.mil/html/COI.xhtml?course_prefix=J3O&course_number=P-US1332.

Family members and others without a CAC card can visit Military OneSource. (Click "financial and legal," then "personal financial management and taxes.")

The training for service members in the Joint Knowledge Online is identical to that offered for the general public. The training offers basics on the options, and offers tools and resources such as a retirement planning worksheet.

Karen Jowers covers military families, quality of life and consumer issues for Military Times. She can be reached at kjowers@militarytimes.com .

Karen has covered military families, quality of life and consumer issues for Military Times for more than 30 years, and is co-author of a chapter on media coverage of military families in the book "A Battle Plan for Supporting Military Families." She previously worked for newspapers in Guam, Norfolk, Jacksonville, Fla., and Athens, Ga.