Graduating basic training. Getting promoted to E-5. Teaching your troops how to field strip an M-4 Carbine in record time. These are milestone moments that can make a service member feel like they’ve accomplished something.

One of the greatest achievements and a rewarding milestone moment is buying your first home — and it’s something every service member deserves for themselves and their family. The thing is, in the military, every piece of equipment has a manual. Unfortunately, buying a house doesn’t — until now.

Here are the seven steps you need to take before purchasing a home, from start to finish.

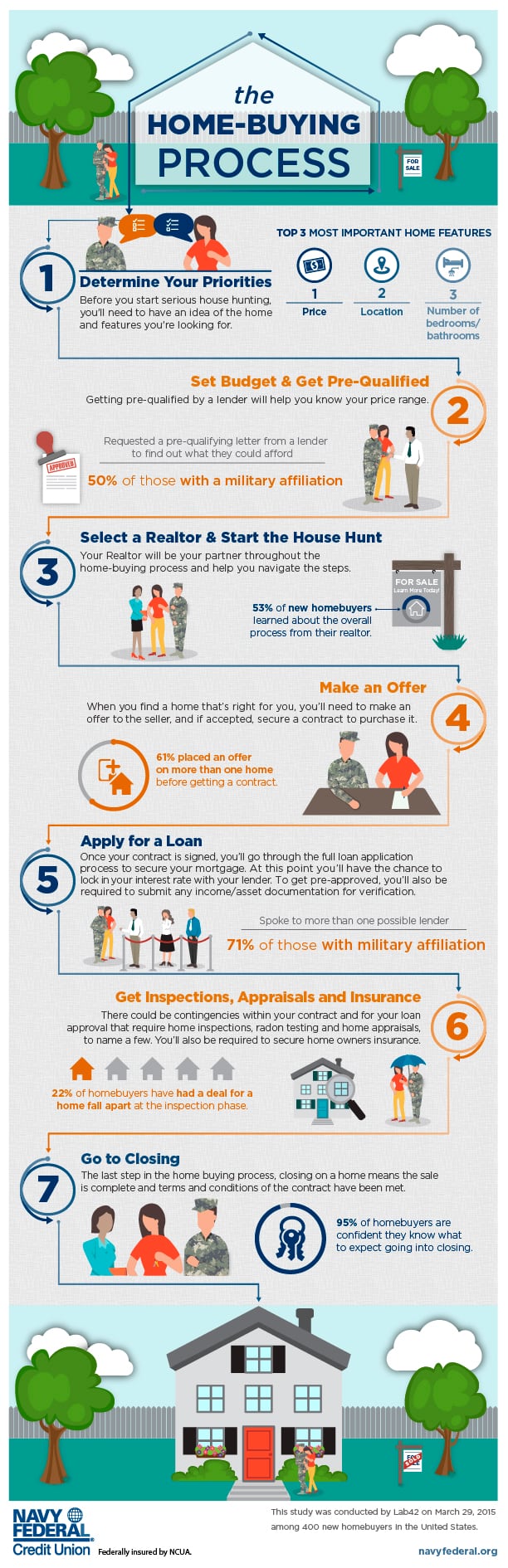

Step 1: Know what’s important — really important.

Knowing your priorities is crucial. And, it can be hard—resist the temptation to think of a want as a need in your new home. Write down and list what you envision your house to be like. How many bedrooms and bathrooms will you need? Determine the amount of square footage you’re comfortable, yard or no yard, etc. Large yards mean maintenance and money. List priorities in order, as you may have to sacrifice one or more to stay within budget, depending on the local housing market. The most important factor is the price. Be realistic and don’t blow your budget (more on that later).

Your next move is figuring out a location. Do you want to be close to the base? Do you mind a longer commute? Look up your Basic Allowance for Housing (BAH) in the ZIP code you’d be living in to determine how much money you’ll receive. The old adage "location, location, location" isn’t a cliché because it sounds nice. It’s a real thing.

Step 2: Set your budget and get pre-qualified

Now that you’ve determined your priorities, it’s time to set your price range based on how much home you can afford. This will depend on your BAH and the availability of homes in your area.

One of the first calls you should make is to a trusted mortgage lender for a pre-qualification. You’ll discuss your overall financial situation including your expected price range, as well as your income, assets and debts. The mortgage lender will then be able to crunch the numbers and tell you a ballpark estimate of how much home you can afford. They’ll also be able to tell you how purchasing a house will impact your budget.

A pre-qualification does not require a mortgage application, fee or a credit check, and can be done quickly over the phone or online. This differs from a pre-approval. A pre-approval requires the lender to check your credit history and is verification the lender is willing to loan you a certain amount of money.

Being affiliated with the military is a major asset. A recent study by Lab42 showed half of those with military affiliation get pre-qualified for a home loan compared with 30 percent of the general population. It’s a useful, not only for planning your finances but also when making an offer on a home. Being pre-qualified shows sellers that you’re a serious buyer.

Step 3: Select a realtor and begin the search

Your realtor will be your partner throughout the home-buying process. Find a trusted adviser, just like how you found a trusted lender. The people you serve with in your unit can be a valuable resource on which local real estate professionals have been good to work with. Even better, your financial institution might have a Realtor referral program—some even offer cash rebates when you close on your loan through them.

Step 4: Make an offer

So you’ve found the perfect home; now it’s time to make an offer! Timing is everything. Markets across the country are rebounding, so don’t be surprised if your first offer doesn’t lead to a contract agreement.

If your first offer isn’t accepted, don’t be discouraged. You’re certainly not alone; 61 percent of new homebuyers placed offers on more than one home before getting a contract. Your realtor will have a solid understanding of what you’re looking for and can get you information on newly listed homes.

Once you’ve made an offer that’s accepted by a seller, both sides will need to sign a contract. Your realtor will know exactly how to guide you through this process. Your contract will include the price of the home, and will also determine who will pay for certain expenses (including closing costs and inspections).

Once the contract is signed by both parties, you’ll need to begin securing your mortgage. Going through the pre-approval process reassures the seller about your seriousness and ability to buy the home. Gather your income and asset documents to make getting approved faster and easier. Then, a loan officer should guide you through to pre-approval. When considering you for a mortgage, they’ll be looking at your debt-to-income ratio, your credit score and more. The lender may also take into account the existing relationship you have with them. Your loan officer should also be able to explain your mortgage options and how those choices will impact your monthly mortgage payments.

Step 6: Get the home inspected, appraised and insured

Your contract with the home seller and lender could include contingencies that require the home be inspected before the deal can close. Depending on your contract terms, either you or the seller will pay to have these completed.

You’ll also need to shop for homeowners insurance. Because options vary by state, make sure you ask your realtor about your choices. Your realtor will likely be able to refer you to a trusted insurance agent to help you find the best and most affordable insurance for you.

Step 7: Close the deal

The long journey of owning your first home is almost over! At closing, you’ll sign a long list of documents to finalize the purchase. You’ll receive a closing disclosure that will provide final closing costs. Once you’ve closed on the house, time to move in!

Being armed with this info will help you as a homebuyer choose the right lender, the right loan, and ultimately the right home to fit your budget and lifestyle. Now the real question will be whether you can find curtains to match the color of your uniform!

You May Also Like:

Navy Federal is federally insured by NCUA and an Equal Housing Lender.

©2016 Navy Federal Credit Union. All Images used for representational purposes only; do not imply government endorsement.