Military taxpayers can save money in a variety of ways when it comes to tax preparation and filing thanks to expert guidance and free services provided by the Defense Department.

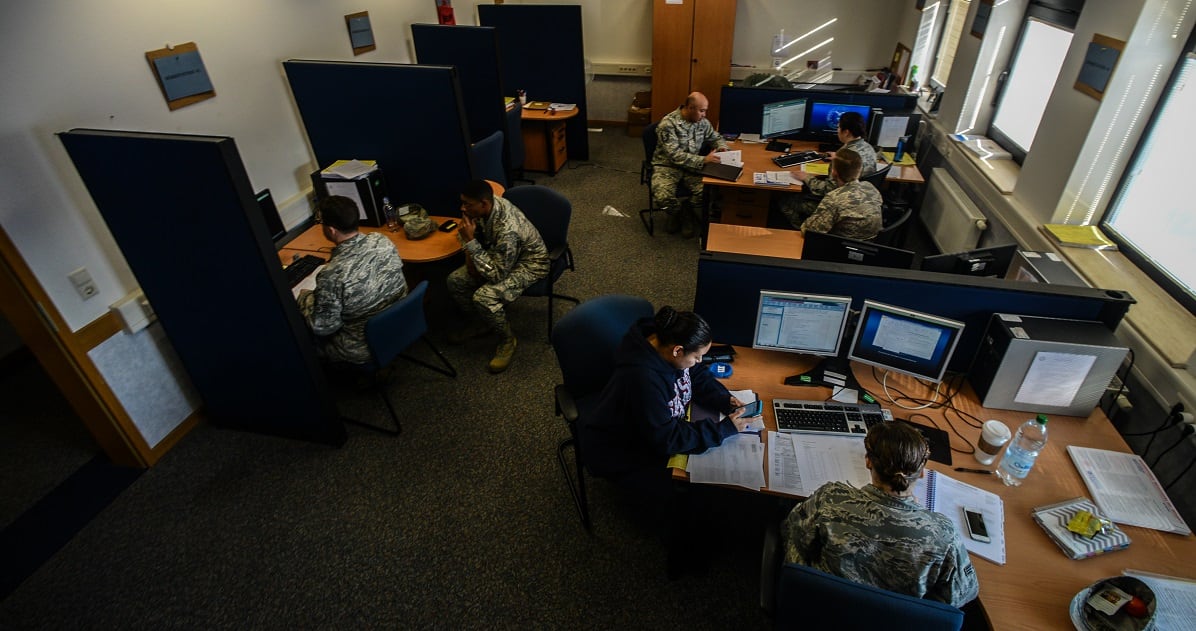

Active-duty members, retirees and their dependents are eligible for free, in-person tax preparation services at 139 military Volunteer Income Tax Assistance locations around the world. VITA tax preparers save their clients an average of $250 compared to what they’d pay for a private-sector tax-prep service, said Army Lt. Col. David Dulaney, the executive director of the Armed Forces Tax Council.

They’re also well-trained by the Internal Revenue Service and the military to address the often-complicated tax situations military members face.

“We work to make sure you get every deduction and credit you’re eligible for,” Dulaney said.

Depending on the situation, that translates into a bigger refund, or into a smaller tax bill come filing time.

These tax preparers are primarily military members who have volunteered their services, Dulaney said. They’ve received more than 80 hours of training, 40 each from the IRS and the military. They must go through a rigorous certification process to earn tax-preparation certification from the IRS.

RELATED

“These preparers in the tax centers are probably better trained than the seasonal employees that are hired by commercial vendors off post,” Dulaney said.

They also have the support of the military legal assistance office and can access the legal assistance chain of command with tax-law questions, reaching back to the Armed Forces Tax Council.

There’s also a quality-assurance check that usually gets three sets of eyes on your return — preparer peer review, noncommissioned officer in charge of the center, attorney in charge of the center — before it’s filed with the IRS.

If you or someone else prepared your taxes without the assistance of the VITA center, you can take your return to the tax center for review. It’s not uncommon for them to find mistakes.

“A lot of times we’ll notice things they’re missing,” Dulaney said. “They could have taken a deduction, or are eligible for a credit.”

If the taxes haven’t yet been filed, the tax center can reproduce the return with their system, and make corrections, for free. If the return has been filed, VITA staffers can help file an amended tax return, Dulaney said: Amended returns can be filed for up to three previous tax years, so you can dig back to 2014.

“I’ve personally worked on tax returns where I was able to find several thousands of dollars that were missed, or filed incorrectly with the wrong state because of misunderstanding of how the Servicemembers Civil Relief Act affects our residency for tax purposes,” Dulaney said.

In addition, service members and their families have access to a variety of free tax preparation assistance at Military OneSource, including free online tax preparation software, and tax consultants who can answer questions.

Military OneSource also lists the military VITA locations, and their contact information.

Karen has covered military families, quality of life and consumer issues for Military Times for more than 30 years, and is co-author of a chapter on media coverage of military families in the book "A Battle Plan for Supporting Military Families." She previously worked for newspapers in Guam, Norfolk, Jacksonville, Fla., and Athens, Ga.