It’s nearly 2018. Are you ready to decide whether to jump to the new Blended Retirement System?

More than 1.6 million service members are eligible to make that choice about their future military retirement benefit, which goes into effect Jan. 1. And while the Defense Department offers mandatory training for those eligible, backed up by service-specific education programs, a recent survey found about half of those who thought they were allowed to switch to the BRS didn’t understand it.

There’s no cookie-cutter approach to this decision; beware of comrades who tell you one plan is always better than the other. We’ve got the basics below, and read on for case studies involving real troops and carefully chosen experts who sort through their financial past and present to help guide their retirement choice.

Some of the nuts and bolts you need to know:

BRS 101

Q. What is this “BRS” thing I keep hearing about?

A. It’s a combination, or “blend,” of the legacy retirement system and some new features. Like the legacy setup, it provides monthly retired pay after at least 20 years of service … but not as much of it.

Beyond that difference, there are three key ways where BRS and the existing setup part company:

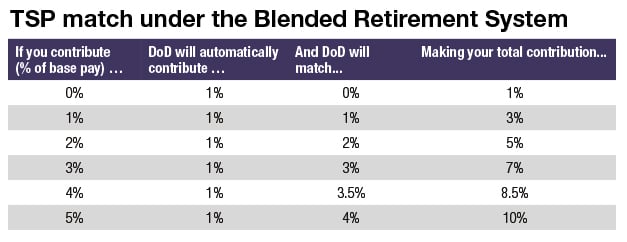

BRS members receive matching Thrift Savings Plan contributions from the Defense Department, which can be as high as 5 percent of monthly basic pay, depending on how much they contribute to their TSP accounts.

At the 12-year mark, BRS members can receive continuation pay in return for a commitment to serve an additional four years. Think of it as a retention bonus (keep reading for specifics).

Instead of waiting for a monthly check, retirees under BRS can opt for a partial lump-sum payout.

Q. What’s the point of the change?

A. Defense Department officials point out that under the current system only about 19 percent of active-duty service members and 14 percent of reservists stay in long enough to earn retirement pay. Under BRS, nearly every service member would get some retirement benefit.

Q. But if I stay in for 20 years under BRS, can I still get monthly retirement pay?

A. Yes, but it is 20 percent less than what you’d get under the legacy system.

Q. How does this affect my other retirement benefits, like medical and commissary?

A. It doesn’t.

Q. How does this affect my spouse’s Survivor Benefits Plan?

A. Service members can still enroll in the SBP, which provides a percentage of your military retirement pay to your spouse in the event of your death. The percentage won’t be affected — up to 55 percent of the pay — but it’ll come out of the smaller retirement amount you’d receive under BRS compared with the legacy system.

OPTING IN

Q. Who is eligible to opt into the new system?

A. Active-duty service members who have fewer than 12 years of total service as of Dec. 31, 2017, can stay with the current system or go with BRS. Same goes for reserve-component members in a paid status with fewer than 4,320 retirement points as of Dec. 31. Also, anyone who entered a service academy or signed a service agreement (those in the delayed entry program, for instance) as of Dec. 31 has opt-in eligibility.

RELATED

Q. I’m not in those groups. I’ve got more time in service.

A. You stay with the current retirement system. You don’t have a choice.

Q. But BRS sounds awesome. Can I get a waiver?

A. No. There is no avenue by law for you to opt into BRS.

Q. Who is automatically enrolled in BRS?

A. Those who enter the military on or after Jan. 1, 2018. Everybody else must opt in to the system.

Q. When do I make a decision?

A. You can opt into BRS at any point during calendar year 2018.

Q. Should I decide now?

A. If you are leaning toward opting in, there’s one good reason, and maybe one great reason, to move fast.

The good: The matching benefits that come with the move — up to 5 percent of your basic pay deposited into your TSP, courtesy of DoD — start the first pay period after you opt in. If you’ve decided to opt in but wait until the end of the year, you’ve missed out on months of DoD contributions.

The great: If you’re going to hit your 12th year of service (or reach 4,320 reservist retirement points) in 2018, you’ll only be eligible for continuation pay if you’ve opted into the BRS before it comes due.

(More later about continuation pay. Promise.)

RELATED

RELATED

RELATED

TSP FOR ME?

Q. Explain how these matching contributions work.

A. Similar to a private-sector 401(k) company match, the BRS offers automatic contributions to a service member’s Thrift Savings Plan — DoD kicks in 1 percent of your base pay automatically, even if you don’t contribute a dime, but will go up to 5 percent of base pay in matching contributions. You put in 5 percent of your base pay to the TSP, DoD kicks in 5 percent. See the chart for a full breakdown.

Q. When can I cash out?

A. The short answer: All who serve at least two years are “vested,” meaning they can keep the DoD contributions. The money you contribute to your TSP is yours from day one.

The long answer: Like all 401(k) plans, you can’t withdraw the money until age 59½ without paying taxes and penalties, unless you move it into another retirement account.

Q. How long will DoD make automatic and matching contributions to the TSP?

A. Until the service member reaches 26 years of service.

Q. Can I still contribute to my TSP if I’m in the legacy system?

A. Absolutely. No match, though.

Q. I’ve never invested in the TSP before. How will my funds be allocated?

A. You’ll be enrolled in your age-appropriate Lifecycle Fund, or L Fund. The contributions will be placed there unless you change your allocation using other TSP funds, which you can do at any time.

Q. What is an L Fund?

A. The Lifecycle Fund is an investment mix, determined by professionals, that is tailored to meet investment objectives based on various time horizons. For example, if you’re younger and have a longer time before your projected retirement, the strategy assumes that you’ll be able to tolerate more risk (fluctuation up and down) in the TSP investments account, to pursue higher rates of return.

CONTINUATION PAY

Q. What is continuation pay?

A. The services will make a one-time payout of continuation pay to those under BRS when they reach 12 years of service.

Active-duty members get 2.5 times their monthly basic pay as of the first day of their 12th year of service. Reserve and Guard members get 0.5 times their monthly pay.

Q. I’m not the best at math.

A. An active-duty E-7 with 12 years of service would receive $10,221.75 in continuation pay, using the 2017 pay tables. ($4,088.70 X 2.5 = $10,221.75).

Reserve E-7s with 12 years would get $2,044.35 ($4,088.70 X 0.5 = $2,044.35).

CHART: BRS vs. LEGACY — Here’s how one typical service member’s retirement cash would play out under a few scenarios under the BRS and legacy systems.

Q. Is there a catch?

A. To receive continuation pay, you must commit to serve an additional four years. Your eligibility for continuation pay is based on your years of service on the day you sign the agreement to serve the additional time.

If you opt in to BRS after you hit the 12-year mark, or don’t sign the continuation pay agreement before the 12-year mark, you’re not eligible for continuation pay.

Q. What if I don’t serve the required extra four years? Do I have to pay back all or part of the continuation pay?

A. That will be determined by the service branch. Each situation is different, but the service member may be required to pay back all or part of the continuation pay.

Q. Can I contribute all or part of my continuation pay to my Thrift Savings Plan?

A. Yes, but keep in mind the Internal Revenue Service annual maximum that can be contributed to tax-deferred savings plans like the TSP. For 2018, that maximum is $18,500.

Moreover, Guard and Reserve members with civilian retirement plans should track their own contributions to all their accounts, because the limit is $18,500 combined.

Q. Is continuation pay taxable?

A. Yes.

Q. Can I receive continuation pay over several years?

A. Yes. You can receive it in four equal installments over four years.

LUMP-SUM RETIREMENT PAY

Q. How does the lump-sum payment work?

A. When you retire under BRS, you can request a lump-sum payment of part of your future retirement pay — either 25 percent or 50 percent of its “discounted present value.”

Q. Discounted what-now?

A. Let’s break it down a bit: Interested service members can get an upfront payout worth a quarter or a half of the retirement pay they’d receive before they reach Social Security retirement age (67 for those born after 1960). But there’s a cost: The amount gets cut by a discount rate published yearly. For 2018, it’s a 6.99 percent slice.

If you take a lump sum, your retirement checks are cut by 25 percent until you reach age 67. If you take half, your payout’s cut by half.

Q. What happens after I reach age 67?

A. The payout returns to the full amount.

Q. What happens if I don’t reach age 67?

A. Spouses will not be required to return any portion of lump-sum payouts in the event of a service member’s death.

Q. When do I request the lump-sum payment?

A. Ask your service branch no later than 90 days before retirement for active-duty members or receipt of retired pay for National Guard and reserve service members.

Q. Is the lump-sum payout taxable?

A. Yes, and it would probably put you into a higher tax bracket.

Q. Can I receive lump-sum payments over a few years to reduce the amount of taxes?

A. Yes, over four years.

Q. Can I contribute my lump-sum payment to my Thrift Savings Plan?

A. No.

PULLING THE TRIGGER

Q. If I opt in to the new BRS and change my mind later, can I revert back to the current retirement system?

A. No.

Q. OK, I still want in. How do I opt in?

A. First, there’s the mandatory BRS training. It’s available through Joint Knowledge Online, your service’s learning management system, and through Military OneSource. That last option isn’t CAC-enabled, so you’ll have to fill out a certificate and provide it to your training manager.

Q. Training’s over. Now what?

A. Soldiers, sailors and airmen can opt in via MyPay at https://mypay.dfas.mil/mypay.aspx. Marines must register their decision with Marine Online at https://mol.tfs.usmc.mil/mol.

Q. I want to stay with the legacy retirement system. What do I have to do?

A. Nothing — unless you’re a Marine. Marines are to register their decision — legacy or BRS — via Marine Online.

“The Marine Corps wants each BRS-eligible Marine to record his or her decision in Marine Online so we know each Marine made a deliberate decision,” Marine Corps spokeswoman Yvonne Carlock said.

If Marines do nothing by close of business Dec. 31, 2018, they’ll remain in the legacy retirement system by default.

FINAL THOUGHTS

Q. Where can I run my own numbers?

A. DoD offers a BRS calculator that allows you to plug in numbers based on your current rank and other factors, to do a general comparison of what you would receive under the legacy system vs. the new BRS.

Q. I have more questions.

A. DoD has deployed about 300 financial counselors across the country, including Guard and reserve centers, to help. That’s in addition to the 475 personal financial managers that already provide education and counseling on bases in the U.S. and overseas.

Military OneSource financial counselors are also available to answer questions, and the service can also refer you to a local financial counselor.

You can check out past and future Military Times coverage of the BRS, including advice from financial experts, under the “military retirement” category of this web site.

Karen has covered military families, quality of life and consumer issues for Military Times for more than 30 years, and is co-author of a chapter on media coverage of military families in the book "A Battle Plan for Supporting Military Families." She previously worked for newspapers in Guam, Norfolk, Jacksonville, Fla., and Athens, Ga.