Think of it as a 5 percent raise.

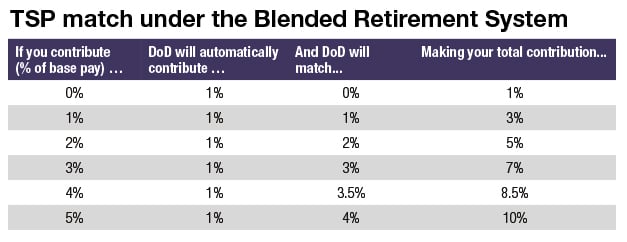

For service members who are in the new Blended Retirement System, the Defense Department will contribute up to 5 percent to your retirement account, assuming you contribute 5 percent of your basic pay. And the bottom line is you don’t want to leave that money on the table.

In 2018, the first year of the BRS, DoD contributed more than $300 million in matching and automatic contributions to service members' retirement accounts, said Air Force Lt. Col. Carla Gleason, a DoD spokeswoman.

Whether you’re an 18-year-old who is new to the military and automatically enrolled in the BRS, or one of the eligible service members who opted in to the system in 2018, you should try to contribute at least 5 percent of your basic pay to your Thrift Savings Plan account.

While we use the term “contribute,” you’re contributing to your own retirement stash. And when you contribute 5 percent to yourself, the result is a 10 percent addition to your retirement account.

While we’re at it, even if you’re not in the BRS, you should strongly consider contributing as much as possible to your TSP. You don’t get a matching TSP contribution under the legacy system, but that doesn’t stop you from building up an extra nest egg.

The TSP is a retirement account, similar to a 401(k) account in the civilian world. You choose a percentage of each paycheck to contribute and how to invest your money.

BRS members who don’t choose an investment fund will have their money put into an age-appropriate Lifecycle Fund, or L Fund.

To change your allocation, visit TSP.gov or talk to a financial adviser. Free financial counseling is available on your installation or via MilitaryOneSource.mil.

For those in the BRS, DoD automatically contributes 1 percent of the service member’s pay, regardless of whether you contribute to your TSP. But DoD also matches up to an additional 4 percent, if you contribute 5 percent.

The money that you contribute to your TSP — and the earnings on that stash — is always yours no matter when you leave the military. But if you take the money from your TSP when you leave, it must go into another qualified retirement account or you’ll get hit with heavy taxes and penalties unless you’re at least age 59 1/2.

For those who opted into BRS: The matching contributions started in the pay period that began on or after the date you opted into the BRS. You were also immediately vested in DoD’s matching contributions, which means you own it and can take it with you whenever you leave.

Of those who opted in to the BRS, about 80 percent of active-duty members and 60 percent of reserve component members are contributing at least 5 percent of their basic pay to their TSP, according to the latest numbers available from DoD.

For those new to the military, automatically enrolled in BRS: You are automatically enrolled with a default contribution rate of 3 percent of your basic pay to the TSP. You can change that amount at any time, within the annual limits set by the Internal Revenue Service. For 2019, you can contribute up to $19,000, with some exceptions.

The 1 percent DoD automatic contribution starts 60 days after you enter the military and continues through 26 years of service. The matching DoD contributions start after two years of service and continue through 26 years. You are vested in the DoD contribution after two years of service, which means you own the money.

Those matching contributions add up.

For example: An E3 in BRS who doesn’t contribute to her TSP for five years is losing out on more than $6,000 in estimated DoD matching contributions and earnings. However, if she contributes 5 percent of her pay to her account over those five years, she’d have around $16,000 in her retirement stash, counting DoD’s match, and the earnings on the money. That’s about 10 times what she’d have with just the 1 percent DoD contribution. (This assumes an investment return of 7 percent.)

If the E3 stays in beyond those extra five years, or leaves the military and continues to contribute to her retirement savings, she’ll be even better off, as promotions and pay increases come.

Karen has covered military families, quality of life and consumer issues for Military Times for more than 30 years, and is co-author of a chapter on media coverage of military families in the book "A Battle Plan for Supporting Military Families." She previously worked for newspapers in Guam, Norfolk, Jacksonville, Fla., and Athens, Ga.